A Canary in the Coal Mine?

Volatility has come back with a bit of vengeance in 2022. The growth stocks that have set the market on fire the last couple years, are now themselves looking to be ablaze, and not in a good way. Some of the hottest names, think Peloton, Zoom Video and the like, are deeply into individual bear markets.

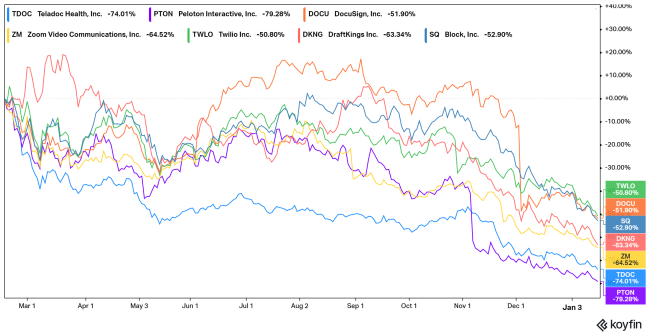

Look at some of these names and performance from their highs in the chart below.

What goes up, can go back down, to paraphrase Newton. And in these instances go down quite far. The faster the move in one direction, a correlation tends to exist if a trend forms in the other. Seemingly even more so on the way down.

Ok, point made. These smaller names are deep into correction. But, that’s ok.

What?!?

These mini-bubbles, add in the steep sell-offs in other stocks like SPACs, recent IPOs and more aggressive areas of the market, bring to mind a an old economic market phrase, “when America sneezes, the World catches a cold”. Can it be applied with a little word play here? Bear with us, the segue will make sense. When these growth stocks sneeze, does the market catch a cold? Reaching? Yeah, I guess a little.

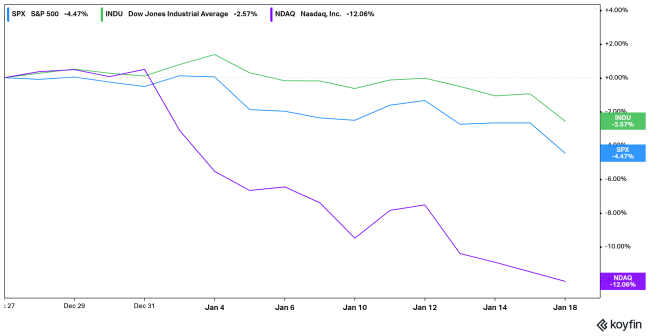

But let's looks a little further. With these incredibly volatile stocks obviously deep into correction, how are the major indexes performing, basically the overall market. Take a look at the chart below.

Whereas many of the popular high growth names from the previous chart displayed fantastic returns in 2020 but generally hit their recent highs all the way back in the 1st Quarter of 2020. The indexes (S&P, Dow and Nasdaq) on the other hand hit their highs within the last month.

And when we look at the relative returns only the Nasdaq is displaying true corrective behavior. And we can credit some of this decline to the fact that Nasdaq will hold more of these high growth names that have been trending lower throughout the past year.

So, the point is, portions of the market are selling off, and steeply. But the market as a whole, and the more “important” names are “holding up” on a relative basis. No they're not completely immune from selling, but they're not seeing nearly the same pressure. For now, the recent sell off feels like just that, a sell off, not an indication that markets are slated to head substantially lower.

It’s also worth saying that research like this only looks at trends. We know that markets are far more nuanced than that. That said, trends do take time to reverse, and for now the pattern appears to be pointing to more widespread moves lower.

At the end of the day these corrections in the more volatile names don’t appear to be the canary in the coal mine for steep market corrections ahead. But our ears are perked up, and listening for that little singing bird.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.